SEMICONDUCTOR INDUSTRY Semiconductor industry outlook for 2025: Demand growing alongside new challenges

Related Vendors

The semiconductor industry is poised for significant growth in 2025, driven by AI, electric vehicles, and high-performance computing, with revenue expected to reach $717 billion. However, the sector faces challenges such as supply chain strain and underinvestment in mature nodes.

The semiconductor industry stands at a critical juncture as we enter 2025. Years of navigating pandemic-induced shortages, geopolitical tensions, and surging demand for cutting-edge technologies have left their mark on the sector. Yet, it remains dynamic and poised for growth. Artificial intelligence (AI), electric vehicles (EVs), and high-performance computing are set to drive revenue to $717 billion this year. However, this growth brings challenges: strained supply chains, uneven investment across technology nodes, and sustainability pressures.

As semiconductors become increasingly essential to life as we know it, from powering advanced AI models to enabling the EV revolution, manufacturers and engineers face a delicate balancing act. The industry must meet accelerating demand while overcoming persistent resource, infrastructure, and geopolitical hurdles.

:quality(80)/p7i.vogel.de/wcms/b4/54/b454dfbb87e7312b8c551bba6538ad93/0122692371v2.jpeg)

CHIP SHORTAGE NEWS

The Global Semiconductor Crisis: A review of Q4 2024

AI-driven demand and supply constraints

AI technologies continue to reshape semiconductor demand. Generative AI, high-bandwidth memory (HBM), and GPUs are key drivers of growth. Bain & Company estimates that rising AI adoption could create a supply crunch, particularly if demand outpaces expectations by more than 20 %. Packaging technologies used in Nvidia GPUs and HBM chips have already experienced tight supply, underscoring vulnerabilities in the global semiconductor ecosystem.

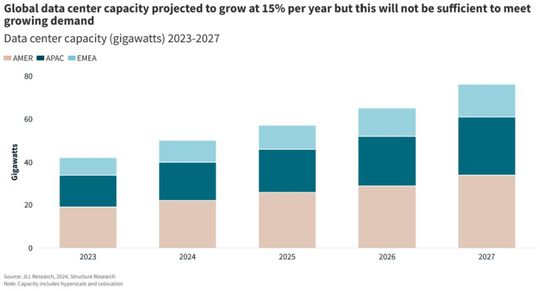

Data centers are emerging as another pressure point, with projected investments growing 36 % in 2024 and continuing to climb in 2025. The accelerating shift toward AI and cloud computing means supply chains will need to scale rapidly to avoid bottlenecks. Yet, the complexity of semiconductor production - relying on thousands of specialized components and vendors - poses ongoing risks to stability.

Mature node shortages persist

While advanced nodes under 10nm receive the lion’s share of investment, mature nodes of 40nm and above face a growing supply imbalance. These older nodes remain indispensable for applications in automotive, industrial, and consumer electronics. S&P Global predicts shortages in these nodes by late 2025, driven by underinvestment during years of focus on cutting-edge technologies.

Automotive semiconductors, for example, depend heavily on mature nodes to support microcontrollers, power management ICs, and sensor technologies. Electric vehicles are set to further strain demand, with the automotive sector projected to triple its semiconductor consumption by 2030. Without a shift in focus, the risk of disruption to supply chains for these critical industries grows.

Some manufacturers are attempting to mitigate these challenges by retooling existing fabs to increase production of mature nodes. However, the timelines for these efforts often extend years into the future. In the meantime, supply constraints could ripple across sectors reliant on these essential components, creating pricing pressure and lead time delays.

:quality(80):fill(efefef,0)/p7i.vogel.de/wcms/5f/fe/5ffedb2e0ffa6/listing.jpg)

Memory market growth (with a caveat)

The memory market is expected to grow by 24 % in 2025, driven by demand for HBM3 and HBM3e in AI accelerators and data center applications. Companies like SK Hynix, Samsung, and Micron have shifted capacity to focus on HBM, which has seen explosive growth due to its integration into AI-enabled GPUs and enterprise solid-state drives.

Despite this growth, the market faces concerns about oversupply. Analysts, including Morgan Stanley, warn that HBM production could outpace demand, with a projected 66.7 % surplus in 2024 potentially impacting 2025 market conditions. This oversupply, coupled with weak DRAM and NAND flash demand, has created uncertainty about the broader memory market’s stability.

Critics of the oversupply narrative argue that HBM’s growth is largely driven by client-specific, customized orders, making surplus less likely. Bain & Company’s projections align with this view, anticipating robust AI-related demand for HBM into the foreseeable future. However, weak consumer electronics demand and excess inventory in DRAM and NAND markets could offset gains in AI-driven segments.

Sustainability and resource challenges

Sustainability remains a pressing concern for the semiconductor industry. Manufacturing processes require vast quantities of water and energy, and emissions from chip production continue to rise. These environmental pressures are particularly acute in regions like Taiwan, where water scarcity poses a direct threat to production.

Many companies are shifting focus to energy-efficient chip designs as part of their sustainability strategies. Chris Richard from Boston Consulting Group points out that energy-efficient chips will play a pivotal role in addressing these challenges. However, balancing environmental responsibility with the need for high-performance chips remains a significant hurdle.

Resource constraints extend beyond water and energy. Geopolitical tensions are disrupting the supply of critical raw materials like gallium and germanium, further complicating production. These materials are essential for advanced semiconductors, and supply restrictions from major producers like China threaten to exacerbate existing supply chain vulnerabilities.

:quality(80)/p7i.vogel.de/wcms/ed/d8/edd83d7b6f7038c7c15a46fdf2bc6fb7/96879394.jpeg)

BASIC KNOWLEDGE - RENEWABLE ENERGY SOURCES

What is renewable energy? Definition, types, and challenges

Geopolitical dynamics

Geopolitical dynamics are increasingly influencing the semiconductor industry. The ongoing trade war between the U.S. and China has led to heightened export controls on advanced chips and manufacturing equipment. China, in turn, has restricted exports of key raw materials, intensifying competition for resources. These tensions have forced companies to reevaluate their supply chains and diversify manufacturing locations.

The U.S. CHIPS Act aims to bolster domestic production, with TSMC and Samsung investing heavily in U.S.-based fabs. TSMC’s new Arizona facilities, supported by $6.6 billion in subsidies, were set to produce 2nm chips using advanced nanosheet technology by 2025, though this has recently been pushed to 2028. While these initiatives aim to reduce dependence on Asian manufacturing, they come with challenges, including talent shortages and escalating costs.

Global logistics disruptions also remain a concern. The Israel-Hamas conflict has impacted trade routes through the Red Sea and Suez Canal, causing significant delays in semiconductor shipments. Shipping times from Asia to Europe and the U.S. have increased by over 10 days in some cases, creating further challenges for just-in-time manufacturing models.

Sector-specific demand trends

Several sectors are driving semiconductor demand as technologies evolve. The automotive sector, particularly EVs, is a standout, with semiconductor content in vehicles expected to increase substantially. Advanced driver-assistance systems (ADAS), battery management systems, and infotainment applications are fueling this growth.

AI and cloud computing remain dominant forces. AI-enabled laptops are forecasted to make up over 50 % of global PC shipments within a few years, while generative AI smartphone shipments are projected to grow 73 % in 2025. These trends underscore the need for advanced semiconductors across consumer and enterprise markets.

The Internet of Things (IoT) and industrial automation also represent significant opportunities. As factories and cities adopt connected technologies, demand for sensors, microcontrollers, and connectivity solutions will rise. These sectors rely on a mix of mature and advanced nodes, highlighting the need for balanced investment across the semiconductor spectrum.

The semiconductor industry is on track for robust growth in 2025, with revenue projected to hit $717 billion. However, navigating this growth will require addressing critical challenges, including mature node shortages, sustainability concerns, and geopolitical disruptions. Sectors like AI, automotive, and IoT offer immense opportunities, but balancing supply and demand across the ecosystem will test the industry’s resilience and adaptability.

(ID:50300557)

:quality(80)/p7i.vogel.de/wcms/2f/f3/2ff3221bf7665de2d0acf83760bfd1fa/0130031523v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/c3/16/c316e955a97f5d72d9678297b237b9e5/0129932858v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/ef/0a/ef0adb0acf793fe147cc27c21f6a7a67/0129954238v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/53/f9/53f9301dfc9292d02960f7996c79cc6e/0129927601v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/6e/cd/6ecd41d095d5111cf4ed37b714844487/0129930878v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/02/c0/02c0e9722f70b1134dbf96fb59a9c73d/0129655179v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/cc/67/cc670ea2029cd2af5c641af70e1bf734/0129816392v4.jpeg)

:quality(80)/p7i.vogel.de/wcms/ea/e6/eae6aee30071e67a5627027974437134/0129544613v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/b1/5e/b15ee02b0ba02db70cf61e37d66ad1d3/0129349127v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/26/d5/26d591cc340077026eac56a0e7564faf/0129949603v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/4d/e0/4de02f76a37cbb3df30dd231de589c8e/0128866890v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/18/0b/180b7b63afc91e523592d8a5ce161c96/0129847487v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/be/c8/bec8d43fc0ee73414274be44608b2970/0129748903v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/23/ee/23ee4a97790d6009dbfd7d9577ffa723/0129220424v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/3c/d1/3cd1cacbceb792ba63727199c61ca434/0127801860v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/5a/a0/5aa0436498af618297961fd54ab36cdf/0126290792v2.jpeg)

:fill(fff,0)/p7i.vogel.de/companies/62/95/6295c25c8dc1a/schunk-sonosystems-300dpi.png)

:fill(fff,0)/p7i.vogel.de/companies/68/08/6808a2b3b6595/het-logo.jpeg)

:fill(fff,0)/p7i.vogel.de/companies/69/30/693022b11e5db/logo.jpeg)

:quality(80)/p7i.vogel.de/wcms/73/1b/731b2a2ed1082e7a4bc6971b76566475/0125343087v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/87/8d/878d28d85fad10c7debc92446c60146b/0123870413v2.jpeg)