CHIP SHORTAGE NEWS The Global Semiconductor Crisis: A review of Q4 2024

Related Vendors

In Q4 2024, the semiconductor industry faced challenges such as natural disasters, geopolitical instability, and delays in fab construction, which highlighted ongoing vulnerabilities in the supply chain.

The global semiconductor industry faced various challenges during the final quarter of 2024. Natural disasters, geopolitical shifts, and evolving market demands highlighted the fragility and adaptability of the supply chain. While the industry had been recovering from earlier shortages, events during this quarter revealed persistent vulnerabilities and raised new concerns.

Hurricane Helene disrupted the supply of high-purity quartz, geopolitical tensions influenced market dynamics, and delays in fab construction slowed long-term production goals. At the same time, rising demand for AI-specific chips signaled an ongoing shift in priorities for manufacturers.

Here’s an in-depth look at the major events and trends that shaped the semiconductor industry from October to December 2024.

Hurricane Helene and its impact on quartz supply

In October 2024, Hurricane Helene caused severe flooding in Spruce Pine, North Carolina, a key hub for high-purity quartz mining. Sibelco and The Quartz Corp, which supply nearly 95 % of the world’s ultra-high purity quartz, were forced to halt production due to damage to facilities and infrastructure. High-purity quartz is indispensable for manufacturing siliconwafers, as it’s used in the production of fused quartz crucibles.

The production stoppage created immediate concerns about potential chip shortages and rising costs. Although many semiconductor manufacturers had stockpiles of quartz to last a few months, the disruption underscored the industry’s dependence on a single geographic region for this critical material. Industry leaders began discussions on diversifying supply chains, improving stockpiling strategies, and exploring alternative materials to avoid future disruptions.

Political instability in South Korea

In Q4 2024, political unrest in South Korea emerged as a significant threat to the semiconductor supply chain. South Korea is a global leader in the production of memory chips, OLED displays, and advanced fabrication equipment. Companies like Samsung Electronics and SK Hynix play leading roles in the industry, supplying chips to tech giants worldwide. However, the country’s political environment raised concerns about the stability of its operations.

:quality(80)/p7i.vogel.de/wcms/1c/c7/1cc792c0829ddf59dbc8dafeb7a5eb7b/0120797265v2.jpeg)

CHIP SHORTAGE NEWS

The global semiconductor crisis: A review of Q3 2024

The instability stemmed from prolonged public protests and escalating tensions between opposing political factions following the impeachment of President Kim Hye-Jung in late September. Allegations of corruption and economic mismanagement had divided the country, with ongoing street protests and labor strikes disrupting operations across several sectors, including tech manufacturing.

Samsung and SK Hynix were reportedly monitoring the situation closely. Although their production facilities remained operational, there were delays in the transportation of components and disruptions in logistics due to strikes by port workers in the United States. The South Korean government attempted to mediate the labor disputes, but uncertainty over potential policy changes and further unrest created hesitation among investors.

This instability also raised concerns about supply chain dependencies. Companies relying on South Korea’s memory chips - used in everything from smartphones to data centers - started exploring alternative suppliers to mitigate risks. Ultimately, these events highlighted the ripple effect political uncertainty in a single country can have on the global tech ecosystem.

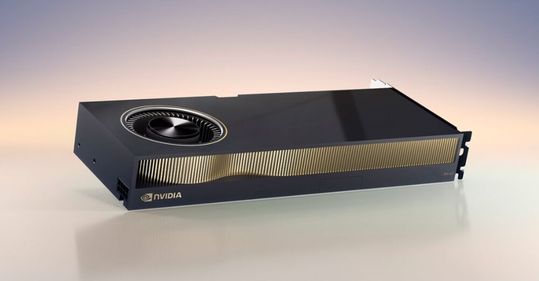

Skyrocketing demand for AI

Demand for AI chips continued to dominate the semiconductor market in Q4 2024. AI applications, including large language models, autonomous systems, and advanced analytics, drove unprecedented interest in high-performance chips. Nvidia remained the market leader, with its GPUs powering most AI infrastructure. The company secured a $1.08 billion priority order from Elon Musk’s xAI project, reflecting the scale of demand for hardware capable of training and running advanced AI models.

Other major players, including AMD and Intel, also ramped up their efforts to produce AI-optimized chips, while new entrants like Graphcore and Cerebras Systems focused on niche AI processing solutions. Qualcomm expanded its AI-focused product line for mobile and edge devices, positioning itself as a key supplier for next-generation consumer electronics.

Despite these advancements, the surge in demand for AI-specific chips created supply chain pressures and worries of potential future shortages. Some chipmakers reported shortages of advanced packaging materials and delays in accessing the latest lithography equipment needed for cutting-edge chip production. Additionally, the prioritization of AI-focused manufacturing left industries reliant on older chip technologies, such as automotive and industrial equipment, struggling to source components.

While overall semiconductor demand was softer than during the pandemic-era boom, the AI sector grew rapidly enough to fuel optimism among industry leaders. Qualcomm CEO Cristiano Amon predicted that AI’s impact on chip demand would extend well into the next decade, but he downplayed concerns of a repeat of the widespread shortages seen in 2021 and 2022.

:quality(80)/p7i.vogel.de/wcms/20/71/207153e4519e1794b37888a955982422/88807673.jpeg)

AI

The impact of artificial intelligence on the semiconductor industry

Looking ahead, the balance between meeting the specialized needs of the AI market and ensuring adequate supply for legacy technologies will remain a critical challenge for the semiconductor industry.

Fab construction delays

Delays in constructing new fabs exacerbated concerns about long-term supply constraints. Projects like TSMC’s $40 billion facility in Arizona, initially expected to begin production by 2024, faced setbacks and were rescheduled for 2028. The focus on producing next-generation chips for AI and cloud computing markets has left industries reliant on legacy nodes, such as automotive and EV infrastructure, struggling to source components.

Various factors are at play here. First and foremost, building and operating a semiconductor fab requires highly skilled workers, including engineers and technicians. Countries like the U.S. and Japan have faced difficulties finding enough qualified personnel, further exacerbated by a lack of robust training programs. For example, TSMC’s Arizona facility cited a shortage of skilled construction workers as a major factor in its delayed timeline.

Equipment bottlenecks are another driving factor. Global demand for semiconductor manufacturing tools has outpaced supply, leading to delays in equipping new fabs. The lead times for advanced tools such as lithography machines have stretched to more than 24 months, creating cascading delays for projects worldwide.

Then there’s the geopolitics. Ongoing tensions between the U.S. and China have complicated the global semiconductor trade. Export controls on critical tools and materials have slowed progress, especially for fabs reliant on international suppliers. Additionally, negotiations between governments and chipmakers over subsidies and compliance requirements have delayed construction timelines.

:quality(80):fill(efefef,0)/p7i.vogel.de/wcms/5f/fe/5ffedb2e0ffa6/listing.jpg)

Despite these setbacks, governments are taking steps to address these challenges through funding initiatives. The U.S. CHIPS Act has allocated $39 billion in manufacturing incentives, with some funds already awarded to major players like Intel and GlobalFoundries. Similarly, the European Chips Act aims to mobilize €43 billion to strengthen the region’s semiconductor capabilities.

However, the rollout of these funds has been slower than expected. For example, the first CHIPS Act grant was only awarded in December 2023, 17 months after the act's passage. Companies like Intel and TSMC have cited slow disbursement as a reason for delaying their projects. Additionally, compliance requirements tied to funding - such as profit-sharing clauses or restrictions on operations in certain countries - have added further complexity to the process.

Chip shortages are still a major pain point

Q4 2024 showcased the semiconductor industry’s ongoing vulnerabilities, from natural disasters and political instability to supply chain bottlenecks and funding delays. At the same time, surging AI demand and government initiatives highlighted areas of growth and adaptation.

The industry must balance its response to immediate challenges, such as fab delays and material shortages, with a forward-looking strategy that diversifies supply chains and prepares for future shifts in technology. The resilience and adaptability shown during this quarter provide a foundation for addressing these challenges, but the road ahead will require continued innovation and investment.

Power Electronics in the Energy Transition

The parameters for energy transition and climate protection solutions span education, research, industry, and society. In the new episode of "Sound On. Power On.", Frank Osterwald of the Society for Energy and Climate Protection Schleswig‐Holstein talks about the holistic guidance his organization can provide.

Listen now!

(ID:50300214)

:quality(80)/p7i.vogel.de/wcms/a4/fd/a4fd7f7a395d6ecb4e79cfc558895b09/0129082772v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/71/fd/71fdcc22d9a9bd2f42985f692c4aefa2/0128924236v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/94/54/94548eaecd020681e558d563bc48ba1d/0128926221v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/29/99/2999bb9af245dd31f4c837c1d9359046/0128923137v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/67/62/676279913d77e1db48eb5cbe9be4c767/0128937895v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/0f/a2/0fa2b5bdc21e408fd73e637d226d5210/0128681532v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/4f/6f/4f6faf0ca6f748a2967d6b5bba7c88e1/0128682406v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/ad/52/ad52f7b5542eff15ba54ec354d31b50d/0128681536v4.jpeg)

:quality(80)/p7i.vogel.de/wcms/1e/9c/1e9c45d6fcf2fb48dc47756e4cb20174/0128931043v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/8b/42/8b4271e1bedea432ab03c83959e30431/0128818204v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/87/5a/875a8fa395c1eec9677e075fae7f5e8e/0128793884v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/2f/93/2f9364112e8c6ff38c26f9ba34d0f692/0128791306v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/3c/d1/3cd1cacbceb792ba63727199c61ca434/0127801860v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/5a/a0/5aa0436498af618297961fd54ab36cdf/0126290792v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/cb/30/cb30ebdca7fcaea281749cb396654eb3/0124716339v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/0b/b4/0bb4cdfa862043eac04c6a195e59b3e0/0124131782v2.jpeg)

:fill(fff,0)/p7i.vogel.de/companies/62/a0/62a0a0de7d56a/aic-europe-logo.jpeg)

:fill(fff,0)/p7i.vogel.de/companies/62/95/6295c25c8dc1a/schunk-sonosystems-300dpi.png)

:fill(fff,0)/p7i.vogel.de/companies/68/08/6808a2b3b6595/het-logo.jpeg)

:quality(80)/p7i.vogel.de/wcms/87/8d/878d28d85fad10c7debc92446c60146b/0123870413v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/4c/5f/4c5f0fb776f0864a409a3b861dfe8757/0122700117v2.jpeg)