CLIMATE NEUTRAL The EU Green Deal and the electronics sector: A strategic imperative for circularity

Related Vendors

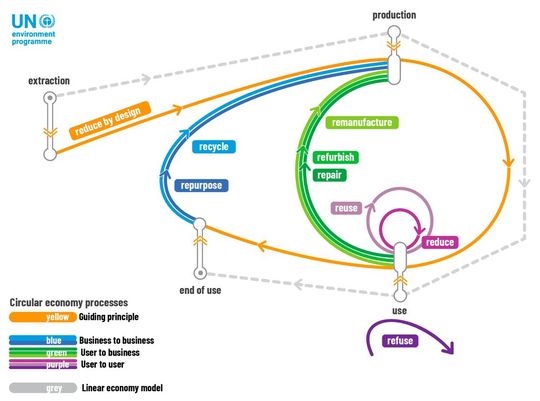

The European Green Deal aims for EU climate neutrality by 2050, focusing on transforming the electronics sector through circular economy principles. It seeks to reduce electronic waste and encourages sustainable practices like reuse and recycling. This shift offers the industry a chance to enhance competitiveness and sustainability.

With sustainability at the forefront of global priorities, the European Green Deal directs the EU's efforts towards attaining climate neutrality by 2050.

The EU Green Deal, definition, strategic scope and relevance for power electronics

Unveiled in December 2019, the European Green Deal is the European Union’s flagship strategy to transition its economy toward climate neutrality by 2050. It is not merely an environmental initiative but a comprehensive economic and industrial transformation plan aimed at modernizing the EU’s economy, enhancing resource efficiency, and decoupling growth from environmental degradation1.

Key pillars include:

- Climate Neutrality by 2050: The EU has committed to becoming the first climate-neutral continent, with a legally binding target to reduce net greenhouse gas emissions by at least 55 % by 2030 compared to 1990 levels1.

- A New Industrial Strategy: This strategy supports Europe’s global competitiveness while guiding industries toward sustainable production and consumption models2.

- Circular Economy Action Plan (CEAP): Aimed at eliminating waste from value chains and promoting reuse, repair, and recycling, the CEAP is central to the EU’s shift toward a regenerative economic model2.

- Zero Pollution Ambition: This initiative seeks to reduce air, water, and soil pollution to levels no longer harmful to human health and ecosystems3.

- Sustainable Products Initiative (SPI): Under the Ecodesign framework, the SPI expands product requirements to include durability, reparability, recyclability, and energy efficiency1.

- These initiatives are increasingly supported by binding legislation, including updates to the Waste Electrical and Electronic Equipment Directive, the Batteries Regulation, and forthcoming laws under the SPI3.

:quality(80):fill(efefef,0)/p7i.vogel.de/wcms/61/09/6109228bdc722/kampagnenbild-webkon-pb-20210831.jpeg)

WEB CONFERENCE: THE FUTURE OF ENERGY

Renewable energies – chances & challenges for a clean future

The e-waste challenge: Magnitude and implications

Electronic waste (e-waste) is one of the fastest-growing waste streams globally, driven by rapid technological turnover, short product lifecycles, and rising consumer demand. According to the Global E-Waste Monitor 2024, humanity generated approximately 62 million tonnes of e-waste in 2022, and this figure is projected to surpass 82 million tonnes by 2030 if current trends persist4.

Within the European Union:

- Over 10 million tonnes of e-waste are produced annually5.

- Only around 40 % is officially collected and treated, while the remainder is often discarded in mixed municipal waste, informally recycled, or illegally exported5.

- These practices result in substantial environmental, health, and economic losses5.

Critical Risks and Opportunities:

- Environmental Impact: E-waste contains hazardous substances such as lead, cadmium, mercury, and brominated flame retardants. When improperly managed, these toxins can leach into ecosystems, causing long-term damage to soil, water, and human health5.

- Resource Depletion: Electronics are rich in critical raw materials (CRMs) like rare earths, cobalt, lithium, palladium, gold, and tantalum. These materials are essential for sectors such as clean energy, defense, and digital technologies, but are increasingly vulnerable to geopolitical risks and supply chain disruptions4.

- Economic Loss: The estimated value of recoverable materials in global e-waste was €55 billion in 2022. Failure to reclaim these resources represents a missed economic opportunity and a strategic risk to Europe’s technological sovereignty4.

The European Green Deal frames e-waste not merely as a waste management issue but as a strategic frontier for resource security, industrial competitiveness, and environmental stewardship6.

:quality(80)/p7i.vogel.de/wcms/f3/41/f3417dc0f6a935cfd890e3ed84d854bc/0105290931.jpeg)

PCIM 2022 KEYNOTE

Hydrogen is the key to achieving net-zero

Why the electronics industry must transition to circularity

The electronics sector is central to the EU’s green and digital transformation, yet it remains one of the most resource- and energy-intensive industries. To align with the European Green Deal, the industry must shift from the traditional linear "take-make-dispose" model to a circular economy approach. This transition involves designing systems where:

- Materials are retained in use through value-retention loops such as reuse, repair, refurbishment, and remanufacturing—collectively known as R-strategies7.

- Products are built for durability, reparability, and upgradeability, minimizing entropy and slowing the degradation of components over time8.

- End-of-life products are reintegrated into production cycles, acknowledging the thermodynamic limits of recycling and the inevitable material losses due to entropy9.

Strategic drivers for circularity in electronics

Under the spotlight of strategic drivers for circularity in electronics, the EU is reinforcing its regulatory framework to promote sustainability and resource efficiency.

Regulatory transformation

The EU is rapidly tightening its regulatory framework:

- The Sustainable Products Initiative (SPI) will expand ecodesign rules to cover more product groups, mandating durability, reparability, and recyclability.

- The Right to Repair movement is gaining legal traction, requiring manufacturers to provide spare parts and repair documentation.

- The Critical Raw Materials Act (CRMA) promotes recycling and substitution to reduce import dependency.

- The Batteries Regulation introduces recycled content mandates and stricter sustainability criteria.

Non-compliance could result in financial penalties, reputational damage, and restricted market access7.

Risk management and supply chain resilience

Global disruptions—from pandemics to geopolitical conflicts—have exposed the fragility of raw material supply chains. Circular strategies such as urban mining, remanufacturing, and component harvesting can localize resource flows and reduce exposure to volatile markets9.

Market and consumer shifts

Consumer and investor expectations are evolving:

- Eco-conscious buyers demand longer-lasting, repairable products.

- Public and corporate procurement increasingly includes sustainability criteria.

- ESG-focused investors are influencing capital allocation.

Circular business models—like product-as-a-service, device leasing, and certified refurbished sales—are emerging as competitive differentiators8.

:quality(80)/p7i.vogel.de/wcms/46/87/468739e21056d9b8e0ddb19b19dbbc66/0119659326v4.jpeg)

GREEN ENERGY

eFuels: The climate-friendly alternative to fossil fuels

Economic value creation

Circularity is not just about compliance—it’s a growth strategy:

- Reduced material input and waste disposal costs

- More revenue from primary markets through upgrades

- New revenue from secondary markets (e.g., refurbished goods, spare parts)

- Enhanced brand value and customer loyalty

The European Commission estimates that circular economy adoption could boost EU GDP by 0.5 % and create 700,000 jobs by 20307.

Practical Steps for Electronics Industry Players

To operationalize circularity, companies should:

- Integrate Eco-Design: Apply R-strategies from the design phase—prioritizing modularity, ease of disassembly, and component longevity7.

- Implement Digital Product Passports (DPPs): Prepare for mandatory digital documentation of product composition and sustainability attributes.

- Optimize Reverse Logistics: Build systems for take-back, refurbishment, and recycling that minimize entropy and maximize material recovery.

- Innovate Materials: Invest in alternatives to critical raw materials, including bio-based and recycled inputs.

- Collaborate Across the Value Chain: Engage recyclers, suppliers, and policymakers to scale circular systems.

- Leverage Data Analytics: Use digital tools to track material flows, assess lifecycle impacts, and improve circular performance.

The road ahead: From compliance to competitive advantage

The European Green Deal is not just a policy shift—it’s a strategic inflection point for Europe’s industrial future. For the electronics sector, this is more than a regulatory obligation; it’s a once-in-a-generation opportunity to lead in a new era defined by resilience, resource efficiency, and sustainable innovation.

Forward-looking electronics-based companies that embed circular economy principles today will not only stay ahead of tightening regulations—they will unlock new value streams, secure supply chain stability, and strengthen their market position in a rapidly evolving global economy.

The message from Brussels is unequivocal: the future of electronics is circular. The real question for industry leaders is no longer if they should adapt—but how fast and how boldly they can drive the transition.

References

(ID:50493891)

:quality(80)/p7i.vogel.de/wcms/71/fd/71fdcc22d9a9bd2f42985f692c4aefa2/0128924236v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/94/54/94548eaecd020681e558d563bc48ba1d/0128926221v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/29/99/2999bb9af245dd31f4c837c1d9359046/0128923137v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/10/78/107856328ef320cc081bf88e0baf95e8/0128685487v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/67/62/676279913d77e1db48eb5cbe9be4c767/0128937895v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/0f/a2/0fa2b5bdc21e408fd73e637d226d5210/0128681532v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/4f/6f/4f6faf0ca6f748a2967d6b5bba7c88e1/0128682406v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/ad/52/ad52f7b5542eff15ba54ec354d31b50d/0128681536v4.jpeg)

:quality(80)/p7i.vogel.de/wcms/1e/9c/1e9c45d6fcf2fb48dc47756e4cb20174/0128931043v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/8b/42/8b4271e1bedea432ab03c83959e30431/0128818204v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/87/5a/875a8fa395c1eec9677e075fae7f5e8e/0128793884v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/2f/93/2f9364112e8c6ff38c26f9ba34d0f692/0128791306v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/3c/d1/3cd1cacbceb792ba63727199c61ca434/0127801860v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/5a/a0/5aa0436498af618297961fd54ab36cdf/0126290792v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/cb/30/cb30ebdca7fcaea281749cb396654eb3/0124716339v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/0b/b4/0bb4cdfa862043eac04c6a195e59b3e0/0124131782v2.jpeg)

:quality(80)/thumbor.vogel.de/f3g2ouosszYDI6Qcyea5EqIzON0=/500x500/p7i.vogel.de/wcms/68/83/6883a88b8c321/ole-gerkensmeyer.jpeg)

:fill(fff,0)/p7i.vogel.de/companies/66/43/66433a241a49d/aurubis-logo-wc-p-rgb-300px.jpeg)

:fill(fff,0)/p7i.vogel.de/companies/68/08/6808a2b3b6595/het-logo.jpeg)

:fill(fff,0)/p7i.vogel.de/companies/69/30/693022b11e5db/logo.jpeg)

:quality(80)/p7i.vogel.de/wcms/99/e7/99e713ba9dc419691f57166a045897b1/0126690706v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/3f/8a/3f8a509fe74fbd8f221e9a0530516b64/0126938143v2.jpeg)